[UK] Halifax dismisses fears of housing market crash despite fall in prices

Mortgage lender says it still expects annual price inflation of up to 3% despite biggest monthly drop since 2010

Britain’s biggest mortgage lender has dismissed fears that the UK housing market is heading for a crash despite posting news of the biggest monthly drop in prices since shortly after David Cameron became prime minister.

Reporting on a month that traditionally marks the start of the spring house-buying season, Halifax said prices were down 3.1%, the steepest fall since September 2010.

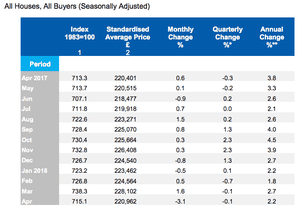

The decline – which followed a 1.6% rise in March – meant the cost of the average home in the UK was cut by £7,140 to £220,962. Over the latest quarter – considered a better guide to the underlying trend – prices were 0.1% lower than in the previous three months.

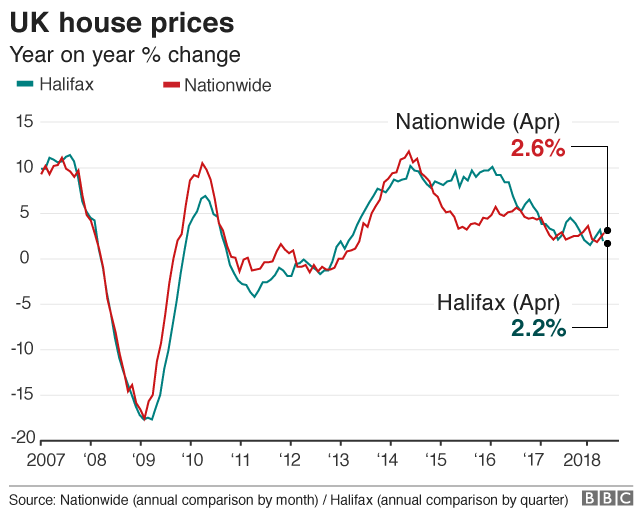

Russell Galley, Halifax’s managing director, said demand for property had been weak in recent months. However, he still expected annual house price inflation to be between zero and 3% this year. In the three months to April, prices were up 2.2% on February to April 2017, down from 2.7% in the three months to March.

Previous sustained falls in house prices have tended to occur only when rising unemployment forces people to sell their homes, but Galley said the UK jobs’ market remained strong. Unemployment is at its lowest level since 1975 and real wage growth has resumed.

Values dipped across the UK for the third quarter in a row, falling 0.1% between February and April, compared with declines of 0.1% and 0.7% in the two previous three-month periods, according to Halifax.

The lender said both the quarterly and annual rates had fallen since reaching a peak last autumn. City analysts say the monthly Halifax figures tend to be more volatile than other surveys.

House prices have been falling in London for some time, especially in wealthier areas, while values in areas outside the capital are still rising. Recent regional figures from Halifax showed the price of a typical house in London was £430,749between January and March, the lowest since the end of 2015.

Jeremy Leaf, a north London estate agent, said the latest figures were disappointing.

“We are entering what is supposed to be the busy spring buying season, which tends to set the tone for the rest of the year,” he said.

“More recently, activity and listings have picked up but we are finding the market still quite sensitive and only those prepared to negotiate hard are moving on.”

Samuel Tombs, the chief UK economist at Pantheon Macroeconomics, said: “Looking ahead, consumers’ low confidence and modest rises in mortgage rates suggest that demand will continue to weaken.

“Prices will fall rapidly, though, only when a large proportion of homeowners are forced to sell up. With unemployment and borrowing costs low and credit freely available, few people are being forced to sell their homes quickly. A period of broadly flat house prices, therefore, remains the most likely outcome.”

No comments:

Post a Comment

Comments always welcome!